posted 6 years ago

I think the premise is misguided.

Historically, land has been the source of wealth. What else would you tax?

Taxes may seem like a pain, but if you refuse to pay taxes in a society that only operates because everyone contributes to keep things like roads, utilities, and emergency services running, what right do you have to those services? That says nothing of countries that provide universal healthcare or any form of socialised medicine, or a social safety net as a carrot to the stick of law enforcement to keep crime down and people safe. The real freeloaders aren't those who have to take advantage of social safety nets, but those who view taxes as a thing to be avoided at all costs.

No, I don't agree with how things are taxed in a lot of cases. I'd prefer a green shift-type strategy, myself, where avoidable dangerous pollution is banned outright, and carbon pollution is taxed. I have no problem with this translating to higher energy costs, as long as there are mechanisms to avoid passing those costs on to those least able to pay them.

To my way of thinking, it's nonsensical to tax income. It literally disincents people from productivity in some cases. We need, I think, to use taxes to both encourage good behaviour, both personally and by business, and to punish bad behaviour.

So things that sequester carbon get tax breaks, or carbon credits with actual purchasing power in a carbon credit marketplace. Imagine if a properly carbon cost-accounted land management scheme could be used to get a partial, or even complete, break on land taxes. Imagine if one could, by using permaculturally-aligned management techniques, increase the rate of carbon sequestration in a system, and have that be a source of income, not just a tax break. Imagine if soil-building was worth a certain dollar value.

Considering your particular wants, Lenny and Freja, I suggest you look at Spain, probably the north eastern part, though I know of at least one community in north western Spain that is paying people something like 3000 euros a piece to move there, and 3000 euros for each child, born or brought over.

But I would expect that, unless there's another way for the society in question to pay for those things, that there will be a correlation between how much taxes are paid per capita and the quality of the services those taxes provide. There is a reason that, in poorer countries, or even in poorer areas of affluent countries, you see gated communities, or individual gated compounds, with private security, for those who live with any hint of affluence. That's because not enough taxes are collected to allow for a coherent law-enforcement regimen, so individuals fend for themselves. Depending on the situation, this might also mean the need for private utilities, including water, waste disposal, and power.

I think there are more important issues to consider over tax laws. I think it more important to be aware of corruption on levels that directly impact private citizens, and of situations that incur other costs at the expense of property taxes, such as fear over the need to be solely reliant on onesself in a situation where local law enforcement is less than reliable, for instance. In the case of a permacultural operation, what good is it to invest your time and energy in the land if someone can come along and set fire to it all, or to steal some from you around harvest, with no repercussions because the police are too few on the ground?

Taxes in good society pay for that kind of assurance, that one can work in peace, and because of that peace, be allowed to keep the fruit of one's labours, without someone trying to take it away, to exchange money for goods in a setting where one can be reasonably assured that the seller is going to be held accountable for any malfeasance, and get one's goods, and onesself, to market.

There's a lot more to it, and yes, I don't always agree with how my tax dollars are being spent, in the same way that I don't agree with how taxation is carried out where I live. But that is something that you work to change to everyone's benefit, not avoid so that others carry the cost of your burdens on the system. If you need examples of the harm that kind of culturally-embraced tax-evasion can cause, look at the financial straits that Greece has been in historically. There is apparently a strong grassroots sentiment that considers paying taxes foolish, largely because there are no consequences for not paying it.

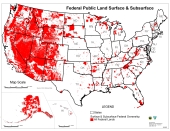

So I would look at the original premise. But the untied states is probably out. Canada only wants self-sustaining taxpayers, so that's probably out too, unless you can credibly claim refugee status. Spain is considered one of the easier places to emigrate to, apparently. But I think the original assessment on the nature of taxes leaves a bit to be desired. I think looking at the services provided for the level of taxes paid is probably the wiser plan, along with, you know, what it takes to emigrate to different countries. I suspect some simply won't take you. Unless I began the lengthy process of claiming my European citizenship through my mother, I would likely have issues moving to some of the nicer places in Europe, even with a Canadian passport.

Good luck, in any case. I hope you get things figured out in the best way possible for your situation.

-CK

A human being should be able to change a diaper, plan an invasion, butcher a hog, conn a ship, design a building, write a sonnet, balance accounts, build a wall, set a bone, comfort the dying, take orders, give orders, cooperate, act alone, solve equations, analyze a new problem, pitch manure, program a computer, cook a tasty meal, fight efficiently, die gallantly. Specialization is for insects.

-Robert A. Heinlein

)

)

) <3

) <3 1

1

2

2

1

1

1

1