Zone 5/6

Annual rainfall: 40 inches / 1016 mm

Kansas City area discussion going on here: https://www.facebook.com/groups/1707573296152799/

Success has a Thousand Fathers , Failure is an Orphan

LOOK AT THE " SIMILAR THREADS " BELOW !

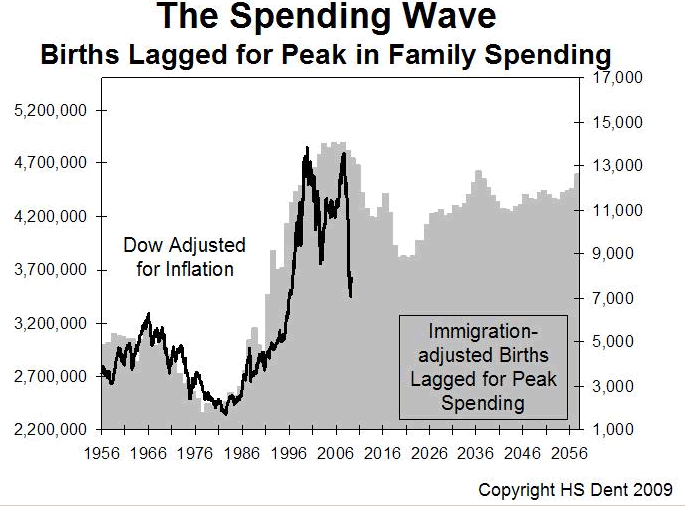

![Filename: DOW.2014.10.15.14.gif

Description: [Thumbnail for DOW.2014.10.15.14.gif]](/t/40476/a/21955/DOW.2014.10.15.14.gif)

My project thread

Agriculture collects solar energy two-dimensionally; but silviculture collects it three dimensionally.

Success has a Thousand Fathers , Failure is an Orphan

LOOK AT THE " SIMILAR THREADS " BELOW !

1

1

Check out Redhawk's soil series: https://permies.com/wiki/redhawk-soil

allen lumley wrote:

I am just reporting that I do not see the trigger,

My project thread

Agriculture collects solar energy two-dimensionally; but silviculture collects it three dimensionally.

allen lumley wrote:

I am just reporting that I do not see the trigger, I am not a bury your head in the sand it can't happen pundit! A.L.

![Filename: oil-3-months.jpg

Description: [Thumbnail for oil-3-months.jpg]](/t/40476/a/24308/oil-3-months.jpg)

My project thread

Agriculture collects solar energy two-dimensionally; but silviculture collects it three dimensionally.

Success has a Thousand Fathers , Failure is an Orphan

LOOK AT THE " SIMILAR THREADS " BELOW !

allen lumley wrote:...There is more copper being recycled NOW than at any other time in history, and -(mostly due to Crack-head scrappers ) ...

If the banks suddenly decide that the value of ingots of copper are only 1/3rd the value placed on them as collateral for short term notes ?

Do you remember when the banks called in the notes of two bros that had temporarily convinced the world they had cornered the Silver Market ?!

After the recent earthquake and tsunami, James Howard Kunstler believes that Japan may be propelled into a much different society very quickly — one that somewhat resemble his World Made By Hand vision. But JHK thinks that using less fossil fuel and decomplexifying their society might be a good thing for Japan as it may give them a headstart down the road that other complex societies like the U.S. are heading anyway.

My project thread

Agriculture collects solar energy two-dimensionally; but silviculture collects it three dimensionally.

Nick Kitchener wrote: I'm expecting to see a continuation in US dollar strength as international capital flows toward the core, and the US stock markets benefiting in particular.

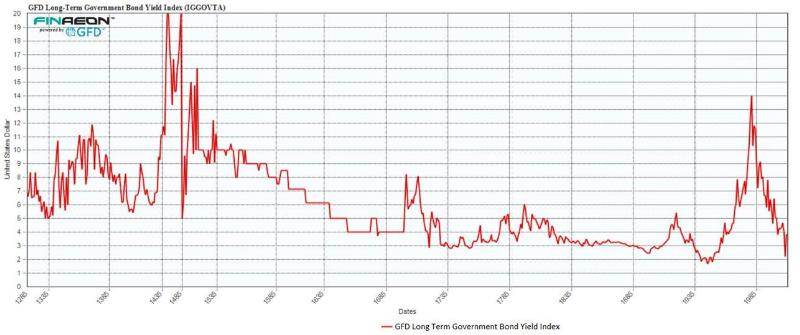

With the world almost in total agreement that rates can only go up, that the 30-year bull market in rates is over and a return to "normal" rates is timely, perhaps a glance at the following chart of 700 years of government bond yields will enlighten a little as to where the anomalies and what the "normal" is. All too often investors are caught up in their cognitive dissonance-driving recency bias when a bigger picture may just help those who always proclaim to invest for the long-term.

My project thread

Agriculture collects solar energy two-dimensionally; but silviculture collects it three dimensionally.

Nick Kitchener wrote:What we are facing is a huge global deflation.

My project thread

Agriculture collects solar energy two-dimensionally; but silviculture collects it three dimensionally.

Big AL

Big AL

Success has a Thousand Fathers , Failure is an Orphan

LOOK AT THE " SIMILAR THREADS " BELOW !

|

Humans and their filthy friendship brings nothing but trouble. My only solace is this tiny ad:

Fed up of Silicon Valley Social Media? Join Retalk, the place of great conversation

http://retalk.com

|